School Program

Sections

Finding the Best Essay Writing Service Reviews: A Guide for Self-Developers Seeking Top Writing Experts

Whether you are a student looking for help with an upcoming essay project, an aspiring

Benefits of Taking Online Journalism Courses

The profession “Journalist” is very popular. Most try to get it at the university. However,

How to become a successful journalist?

The specialty “journalism” is very popular in universities. There is a huge competition for budget

How to Choose the Right Sources of Information?

A person who possesses information rules the world. This statement is surely true! When you

Newsbreak and genres

The informational genres-newspaper article, report, report, interview-are distinguished by their immediacy, by the presence of

News Note

This type of news item combines the reporting and analysis of an event by identifying

Multimedia journalism

Multimedia journalism is a certain way of presenting journalistic material. It is a media product

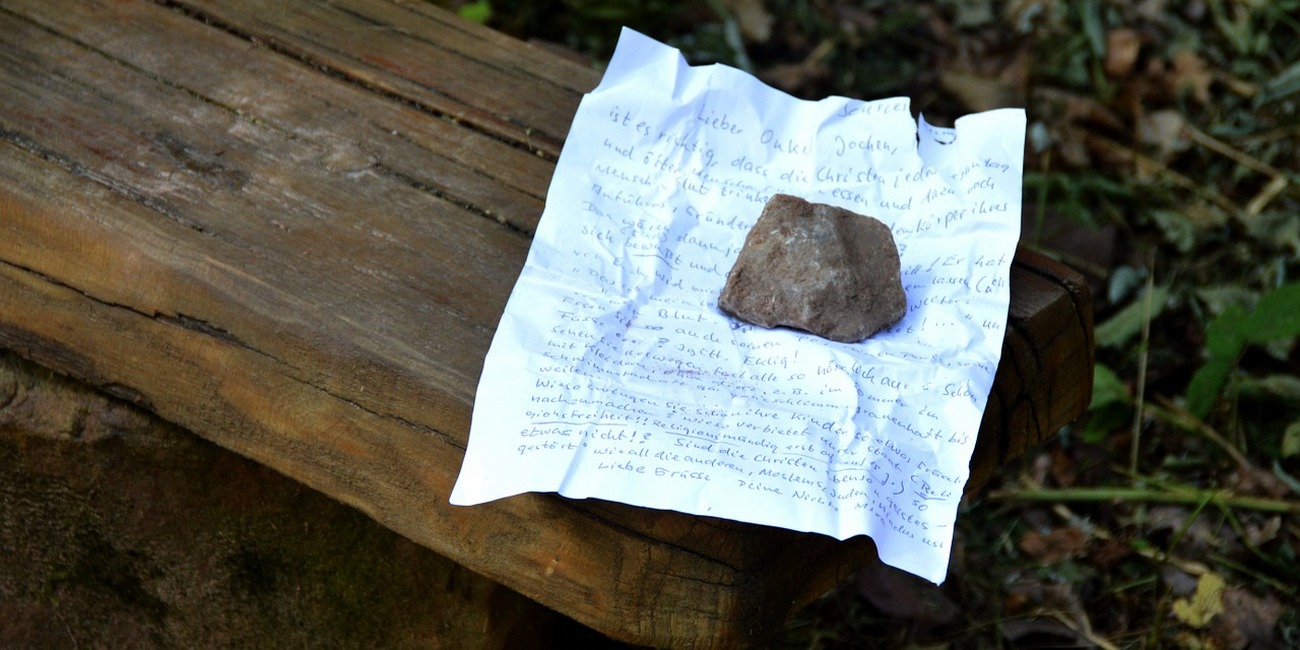

Fakes and fact-checking

In our courses, we pay a lot of attention to the basics of practical journalism

Headline and lead

Every journalistic story begins with a headline and a lead. This rule is unbreakable regardless

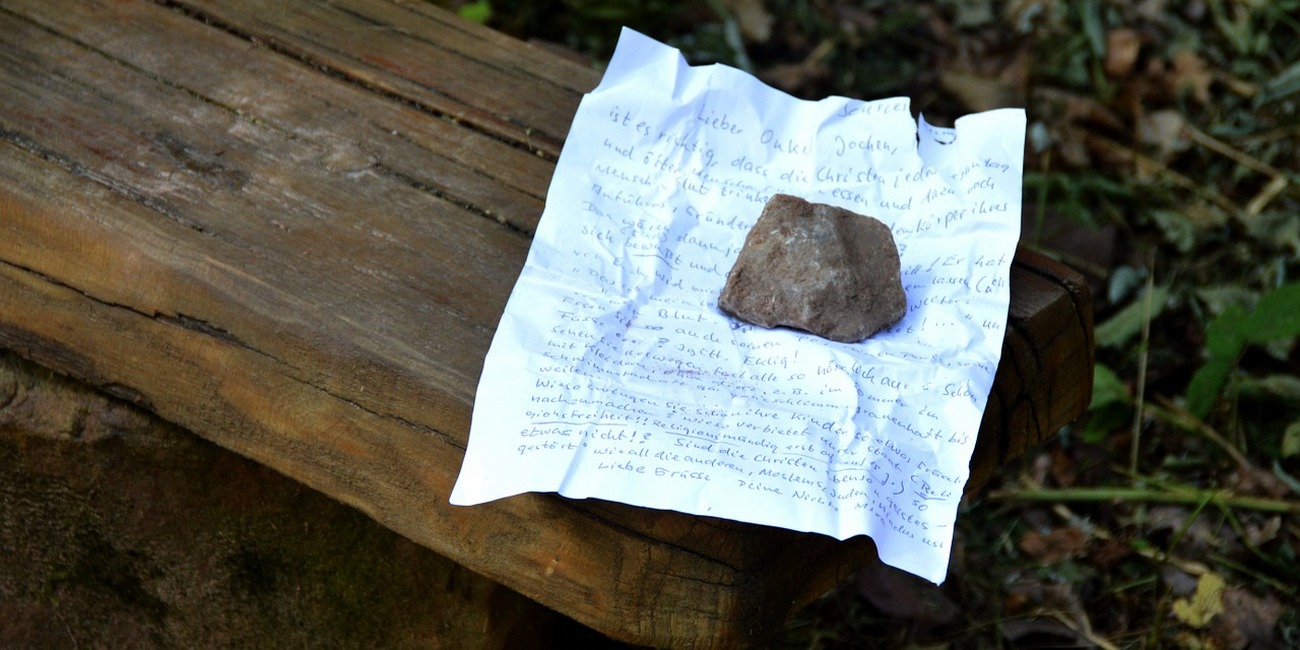

Sources of information

In the course of our journalism school, we go into detail about all possible sources

Finding the Best Essay Writing Service Reviews: A Guide for Self-Developers Seeking Top Writing Experts

Whether you are a student looking for help with an upcoming essay project, an aspiring

Benefits of Taking Online Journalism Courses

The profession “Journalist” is very popular. Most try to get it at the university. However,

How to become a successful journalist?

The specialty “journalism” is very popular in universities. There is a huge competition for budget

How to Choose the Right Sources of Information?

A person who possesses information rules the world. This statement is surely true! When you

Newsbreak and genres

The informational genres-newspaper article, report, report, interview-are distinguished by their immediacy, by the presence of

News Note

This type of news item combines the reporting and analysis of an event by identifying

Multimedia journalism

Multimedia journalism is a certain way of presenting journalistic material. It is a media product

Fakes and fact-checking

In our courses, we pay a lot of attention to the basics of practical journalism

Headline and lead

Every journalistic story begins with a headline and a lead. This rule is unbreakable regardless

Sources of information

In the course of our journalism school, we go into detail about all possible sources

How does school work?

Our school is meetings that take place once a week in the library in a face-to-face format, as well as online. The students will talk to journalists, learn about the basics of the profession, and do practical exercises. The duration of the course – 5 months.

What are the conditions?

You can become a student of the school if you are from 16 to 35 years old. And to get a certificate of completion of the course, you need to attend all classes and lectures (or watch them) and do all the homework. At the end of training there will be a final test. However, it is not forbidden to be a “free listener”.

Lots of information

Where and when did the first newspapers appear? How many types of interviews are there? How do you write an essay? Who is the greatest journalist? History, genre features, journalist’s rights, and more.

Interesting introductions

Our instructors are true professionals: editors and correspondents of urban media, photographers, videographers, philologists. They are willing to share their vast experience!

Mandatory Practice

All themes of the course are theory + practice. For example, having learned the basics of news journalism, the students make their own news. And when they learn about “Radio”, they make up their own show.

Test of knowledge

After each lesson, students are given homework, e.g. an interview or an essay. At the end of the course, they are given a test, a real test of what they have learned.